by on APRIL 10, 2008 - http://www.vccafe.com/2008/04/10/the-golden-age-israeli-startups-experience-funding-streak-part-i/

Now here’s an investment that was hard to track in English. Israel’s Actus-Imago, has developed a suite of services for media related companies, to help them cover all the management aspects and workflow of broadcasters and content providers. Its clients include CME, India’s Zee Networks, Fox and also government agencies and censor groups. Through its Insight product, Actus-Imago provides search and speech recognition in audio and video content. The one million dollar round was led by Israeli investment bank Rimon Capital and private investors from Israel and abroad. Actus-Imago wasfounded by Israel Kehat, Sima Levy and Lior Boker.

Now here’s an investment that was hard to track in English. Israel’s Actus-Imago, has developed a suite of services for media related companies, to help them cover all the management aspects and workflow of broadcasters and content providers. Its clients include CME, India’s Zee Networks, Fox and also government agencies and censor groups. Through its Insight product, Actus-Imago provides search and speech recognition in audio and video content. The one million dollar round was led by Israeli investment bank Rimon Capital and private investors from Israel and abroad. Actus-Imago wasfounded by Israel Kehat, Sima Levy and Lior Boker.

WebCollage has developed a turnkey SaaS solution for content integration – taking content from the manufacturer’s site and distributing it seamlessly on the distributor’s consumer-facing site (see how it works here). Retailers and manufacturers use WebCollage also to fine-tune their rich media strategies, as consumers’ love for online video builds. For example, the company is working with CircuitCity.com to enhance the user experience on the site by providing how-to videos and product tours shot by employees. WebCollage has 100 employees, half of them in Israel. The company’s products are currently installed on 750 ecommerce sites worldwide, reaching $20 million in sales with the leadership of CEO Yehuda Doron.

WebCollage has developed a turnkey SaaS solution for content integration – taking content from the manufacturer’s site and distributing it seamlessly on the distributor’s consumer-facing site (see how it works here). Retailers and manufacturers use WebCollage also to fine-tune their rich media strategies, as consumers’ love for online video builds. For example, the company is working with CircuitCity.com to enhance the user experience on the site by providing how-to videos and product tours shot by employees. WebCollage has 100 employees, half of them in Israel. The company’s products are currently installed on 750 ecommerce sites worldwide, reaching $20 million in sales with the leadership of CEO Yehuda Doron.

D-Pharm Secures Funding From Israel’s Chief Scientist’s Office

D-Pharm Secures Funding From Israel’s Chief Scientist’s Office

D-Pharm, a clinical stage biopharmaceutical company pioneering the development of lipid-like therapeutics, has received a commitment from Israel’s Chief Scientist’s Office (CSO) to match expenditures on four of D-Pharm’s R&D programs with a total grant of up to NIS 11 million (over $3 million). The Chief Scientist’s Office has supported D-Pharm since its establishment, providing grants of about $18 million, excluding this latest announcement.

Since I started following the Israeli market in 2005, it’s not often that I’ve seen so many Israeli startups raise money in such a short period of time. Capital raising is seen across the board in Telecommunications, Cleantech, Internet, Consumer Electronics and Biotech in the last couple of weeks. Is this the Golden Age of Israeli startups? Or are institutional investors looking eastbound for a cushion to protect them from the imminent recession in the west?

Part I – The Israeli venture capital scene

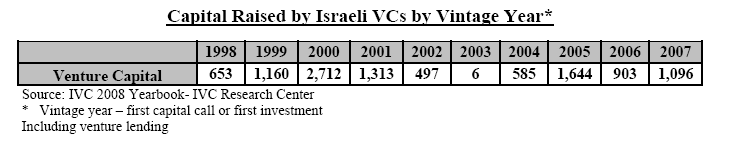

In a recent study, the IVC Research Center reports that the capital available for investment in the hands of Israeli VCs is now at $2 billion, making conditions ripe for the number of investments we’ve seen in the past couple of weeks. In 2007, Israeli venture capital funds raised a total of $1.1 billion (including venture lending), 21% more than in 2006. Not bad.

However, it looks like 2008 is going to bring a slowdown to the fast-paste that the industry is currently experiencing: VCs in Israel are projected to raise only $800 million this year, and it would be naive to believe that the available capital will find its way to early stage tech: Talia Aben, a former Gemini carefully points out that only two of the funds mentioned in the report (Pitango and Tamir Fishman)will invest in early stage IT. The rest of the funds are focused on Healthcare (Pontifax, 7Health, Agate, and SCP Vitalife), CleanTech (Israel Cleantech and AquAgro) and mid tech (Wanaka Capital and Aviv).

Despite the sense of optimism, Aben advised entrepreneurs to keep their budgets tight to the dollar, focus on building clear road maps and meeting product and revenue deadlines. I couldn’t agree any more. There are a few ominous signs in the horizon:

* According to the latest VC Indicator quarterly survey by Deloitte Brightman Almagor, 75% of Israeli venture capital managers expect to see a decrease in the number of funds operating in Israel by 2010. The main reason for closure is predicted to be difficulty in raising follow on funds (see Walden Israel)

* Funds are slowing down investments in early stage tech companies. One example is 3i Group, a leader in PE and VC with over $10 Billion under management, and one of the main investors in Giza Venture Capital. 3i Group’s CEO Philip Yea recently announced that the firm will no longer invest in early stage companies. i3 had previously made a few direct investments in several early stage Israeli startups, including IntelliDX Inc. (formerly Glucon), InLive Interactive Inc., Transtech Control Ltd., and OmniGuide Inc.

* Six Israeli VC funds completed their initial but not necessarily final capital-raising last year (MarketWatch):

– green funds AquAgro and Israel Cleantech- medical devices fund Agate Investments- SCP Vitalife and DFJ Tamir Fishman, are partnering Israeli firms with foreign investors to complete funding- Aviv Venture closed a second fund

ROI – Run or Invest?

On a separate study, IVC Research reports that in 2007, 27 Israeli high-tech companies raised $701 million through initial public offerings on US, European and Israeli stock exchanges. In addition, M&A activity involving Israeli companies that were either acquired or merged totaled $3.2 billion in 2007 in 75 deals – the second highest number of M&A deals in any one year to date.

Guy Holtzman, IVC’s CEO adds:

“The current economic climate is affecting both VC funds and high-tech companies. Still, the level of foreign institutional investor interest and activity continues high, and Israeli institutional investors are increasing their allocations to Israeli VC and private equity funds. Concurrently, uncertainty in the capital markets and the weakness of the dollar are causing Israeli high-tech companies to seek more funds in order to meet their financial needs.”

THE ANT AND THE CRICKET

THE ANT AND THE CRICKET

More M&A, less IPOs, we get it. I don’t think the VCs care, as long as there is a growing deal flow in the horizon and returns are positive.

In summary, what seems to be the golden age of Israeli start up funding, could be compared to the fable on the ant and the cricket. If you’re a funded startup, don’t just sing along in the summer. Work hard and collect the grains during the harvest time so you can enjoy the winter later on.

In the last post I discussed the background of what seems to be the fuel behind the golden age of Israeli startups. Israeli venture capital funds have $2 billion in hand, and projections say an additional $800 million will be raised in 2008. The Economist however, seems to disagree by predicting a pessimistic future to Israel, in a special report of this week’s printed edition. The Jerusalem Post summarized The Economist‘s Special report:

Israelis ought to reappraise even that sunny patch of optimism. Citing the country’s aggressive unions, over-dependence on the high-tech sector, widening wealth gaps, a faltering education system, low workforce participation and a public sector paralyzed by bureaucratic red tape, the esteemed British magazine claims that “the engines of growth are punier than they look.”

In conclusion the Economist adds:

“The country’s greatest vulnerability is not military but economic Israel’s future is as uncertain as at any time in its 60 years of history.“

I’d like to join The Jerusalem Post in a rebuttal to the Economist’s grim overview by providing a snapshot of VC investments in Israeli companies, in the past couple of weeks.

Small Phone, Big Round: Modu’s $100 million lottery ticket

Small Phone, Big Round: Modu’s $100 million lottery ticket

Founded a year and a half ago by Dov Moran, Modu Ltd, has secured commitments for $100 million investment in the next few weeks. Modu was evaluated at $150 million before the money. In this case, the founder’s track record helped facilitate this unusually large round. Mr. Moran is considered one of the fathers of flash memory, having previously founded m-systems (NSDQ: FLSH), a company that was sold to SanDisk Corp (Nasdaq:SNDK) for $1.6 billion. Modu has so far raised $20 million from Genesis Partners, Gemini Israel, SanDisk and Moran himself. Modu has developed the world’s smallest cell phone (see Guinness record), with the ability to plug-in and transfer information to other devices through the use of “Jackets”, which essentially transform the phone into a GPS, music player, digital camera, computers, etc. Most recently Modu signed an exclusive distribution agreement in Israel with Cellcom and struck a partnership with Universal Music Group (UMG) for the development of music “jackets”. If consumers adopt its product, Modu could change the way we use cellphones in the future. Learn more in this cool video of Modu and on my previous posts.

Media intelligence system Actus-Imago raised $1 million

Now here’s an investment that was hard to track in English. Israel’s Actus-Imago, has developed a suite of services for media related companies, to help them cover all the management aspects and workflow of broadcasters and content providers. Its clients include CME, India’s Zee Networks, Fox and also government agencies and censor groups. Through its Insight product, Actus-Imago provides search and speech recognition in audio and video content. The one million dollar round was led by Israeli investment bank Rimon Capital and private investors from Israel and abroad. Actus-Imago wasfounded by Israel Kehat, Sima Levy and Lior Boker.

Now here’s an investment that was hard to track in English. Israel’s Actus-Imago, has developed a suite of services for media related companies, to help them cover all the management aspects and workflow of broadcasters and content providers. Its clients include CME, India’s Zee Networks, Fox and also government agencies and censor groups. Through its Insight product, Actus-Imago provides search and speech recognition in audio and video content. The one million dollar round was led by Israeli investment bank Rimon Capital and private investors from Israel and abroad. Actus-Imago wasfounded by Israel Kehat, Sima Levy and Lior Boker.

Storage Compression: Lehman, Bessemer and Sequoia Put $19 Million into Storwise

Storage Compression: Lehman, Bessemer and Sequoia Put $19 Million into Storwise

Storwise provides a unique, transparent, real-time storage compression solution that dramatically boosts available storage space. In a third round this week, it managed to secure $19 million from Lehman Brothers, Bessemerand former investor Sequoia (US). Other investors in Storwise include Tokyo Electron Device, who distributes the company’s products in Japan and also Tamares Group, a private equity group, represented in Israel by Yodfat Harel and Meirav Har Noy. Founded in 2004 by Gal Naori and Yoni Amit, Storwise’s technology enables compression of the data before it gets stored by EMC or Network Appliance systems, thus greatly improving the storage process and saving resources.

Content-Distribution is King: Israel’s WebCollage Raises $10 Million in sixth round

Content-Distribution is King: Israel’s WebCollage Raises $10 Million in sixth round

Founded in 2000, WebCollage could be considered a veteran in the internet world. In its sixth investment round, the Israeli enterprise IT startup WebCollage was able to secure a$10 million round, led by Greylock Partners, who was joined by current investors Cedar Fund, Gilde Investment Management, and Sierra Ventures. This round puts WebCollage at $42.1 million raised to date.

WebCollage has developed a turnkey SaaS solution for content integration – taking content from the manufacturer’s site and distributing it seamlessly on the distributor’s consumer-facing site (see how it works here). Retailers and manufacturers use WebCollage also to fine-tune their rich media strategies, as consumers’ love for online video builds. For example, the company is working with CircuitCity.com to enhance the user experience on the site by providing how-to videos and product tours shot by employees. WebCollage has 100 employees, half of them in Israel. The company’s products are currently installed on 750 ecommerce sites worldwide, reaching $20 million in sales with the leadership of CEO Yehuda Doron.

WebCollage has developed a turnkey SaaS solution for content integration – taking content from the manufacturer’s site and distributing it seamlessly on the distributor’s consumer-facing site (see how it works here). Retailers and manufacturers use WebCollage also to fine-tune their rich media strategies, as consumers’ love for online video builds. For example, the company is working with CircuitCity.com to enhance the user experience on the site by providing how-to videos and product tours shot by employees. WebCollage has 100 employees, half of them in Israel. The company’s products are currently installed on 750 ecommerce sites worldwide, reaching $20 million in sales with the leadership of CEO Yehuda Doron.

XTellus Gets $8.3 to develop Optical network

XTellus Gets $8.3 to develop Optical network

Israeli startup Xtellus Ltd, a leading supplier of scalable Wavelength Selective Switches (WSS) for reconfigurable optical networks, has raised $8.3 million in its second financing round. The round was led by NanoDimension LP, joined by previous investors Israel Seed Partners, Alta Berkeley and Goldman Ventures. This puts XTellus at $25 million raised to date. XTellus plans to use the proceeds to meet rising global demand for Optical Network equipment, to large equipment makers, such as Cisco and Alcatel.

Israeli Biotech Startup ModiGene Raises $12 million within a year of raising $15M

Israeli Biotech Startup ModiGene Raises $12 million within a year of raising $15M

Based in the Weizmann Science Park in Israel, Israeli startup ModiGene (Bulletin Board: MODG) is going to reduce the number of injections needed to achieve the same therapeutic effect from the same dosage; ModiGene is applying its patented technology to develop longer-acting versions of already approved therapeutic proteins. The Frost Group LLC saw the potential and decided to makeits second investment in Israel,leading a round of $10 million, with an additional $2 million coming from private investors. ModiGene was founded at Technion Entrepreneurial Incubator Co. Ltd. (TEIC) and is currently registered in the US. The company, founded in 2001, is run by CEO Dr. Avraham Havron and president Shai Novik.

Israel’s Kenshoo Gets Backing From Arts Alliance and Sequoia

Israel’s Kenshoo Gets Backing From Arts Alliance and Sequoia

To compete with a giant like Google’s Double Click, you’re going to need deep pockets. Israeli startup Kenshoo automates the labor intensive process of creating and managing SEM campaigns. UK-based VC firm Arts Alliance invested an undisclosed amount in Kenshoo last week, following a previous round led by Sequoia in December of 2007, also with undisclosed terms. This is Art Alliance’s second investment in an Israeli company – it previously backed YCD multimedia, developer of digital audio/ visual solutions for commercial environments.

Kenshoo Search, the company’s flagship product helps site owners to select relevant keywords for their campaigns, dynamically updates the content on landing pages to improve conversions and ROI and even identifies click fraud in real time (learn more about the product’s features). Despite being young, Kenshoo is a worthy contender in the battle against DoubleClick, aQuantive’s Atlas Solutions, and Omniture. The Israeli startup not only provides metrics and reporting, but also looks at the quality of the campaigns. Based in Israel, Kenshoo was founded in 2006 by Yoav Izhar-Prato (CEO), Alon Sheafer (CMO) and Nir Cohen (CTO). (Learn more on TheMarker).

Evergreen funds Internet start-up Libox

Evergreen funds Internet start-up Libox

Evergreen Venture Partners has led a $1 million first financing found in Israeli Internet start-up Libox founded by CEO Erez Pilosof, who is also a founder of Internet portal Walla Communications Ltd, one of Israel’s largest search and content portals. Other investors are Igal Ahouvi’s Partam Tel Aviv Ltd. and private investor Ilan Tirosh. Libox remains stealth at this point, but according to sources Pilosof is working on a consumer facing application that will compete with Google and Microsoft. TheMarker reports that Libox is now working on the creation of several patents at this time. Pilosof is a serial entrepreneur who recently founded ViralGurus.com, a platform that helps users to distribute flash, video, games and other media content.

Mobile Gaming Start-up Raises $400,000 in Seed Round Investment

Mobile Gaming Start-up Raises $400,000 in Seed Round Investment

Mo’Minis (Mobile Minis), an Israeli-based start-up has raised seed round funding of $400,000 from private investors led by Baruch Levanon. MoMinis solution provides a one-stop-shop for rapid mobile content creation and distribution. The innovative platform combines easy development & porting of interactive content and mobile games with a highly efficient delivery system. The site is still in stealth mode, but the service is expected to launch later this year. Mo’Minis was founded in 2006, by four alumni of intelligence unit 8200: Zvi Rabinovich, Tzach Hadar,Aviv Revach and Eyal Rabinovich. The founders believe that Mo’Minis is positioned for success by being the first mover in the category.

Clean Water Technology Startup AqWise Raises $3.6 Million

Clean Water Technology Startup AqWise Raises $3.6 Million

AqWise, a Herzliya, Israel-based developer of wastewater treatment technology, raised $3.6 million in funding. The company said existing investors AHMSA Steel Israel, Elron Electronic Industries (Nasdaq: ELRN) and Israel Clean Tech Ventures participated in the round. AqWise plans to use the proceeds to grow its presence and market reach around the globe, as well as to continue development of its Attached Growth Airlift Reactor fixed biofilm moving bed process. No doubt that solar energy is on the rise.

D-Pharm Secures Funding From Israel’s Chief Scientist’s Office

D-Pharm Secures Funding From Israel’s Chief Scientist’s OfficeD-Pharm, a clinical stage biopharmaceutical company pioneering the development of lipid-like therapeutics, has received a commitment from Israel’s Chief Scientist’s Office (CSO) to match expenditures on four of D-Pharm’s R&D programs with a total grant of up to NIS 11 million (over $3 million). The Chief Scientist’s Office has supported D-Pharm since its establishment, providing grants of about $18 million, excluding this latest announcement.

And the list goes on…

Need I say more? Going back to Jerusalem Post’s response to the Economist:

Israel leads the world in research and development spending as a proportion of GDP. The country hosts the greatest number of NASDAQ-listed companies after the US and Canada.Export earnings are up. Tourism is up. So are property prices. Just this month, Forbesmagazine rated Israel as the world’s most “up-and-coming” real-estate market.

So it sounds like after all, Israel can take pride in its economic achievements. A country that only exists 60 years has gone so far despite the intifada, corruption, unions and bleeding of its best brains to the US and Europe. I believe that Israel has every reason to be optimistic, and hope that despite the political turmoil, or maybe because of it, Israel will pull through and improve the deficiencies, that made the Economist wonder in the first place.

Comments